Treasury advisory and technology for complex organisations

Mid-market businesses face institutional-level complexity but rarely have institutional-level support. We start with hands-on advisory — establishing policies, optimising banking, and sourcing working capital — then provide the technology to run it day-to-day.

Trusted by international businesses:

Strategy and expertise first, technology to execute

We bring the advisory your finance team needs, backed by the platform to put it into action

Treasury strategy & governance

We design your treasury policies, risk frameworks, and governance structures — so your board and auditors have confidence in how you manage international finances.

Banking & working capital

We review your banking relationships, negotiate better terms, and source working capital solutions — from trade finance to supply chain financing — to improve your cash conversion cycle.

Full treasury technology

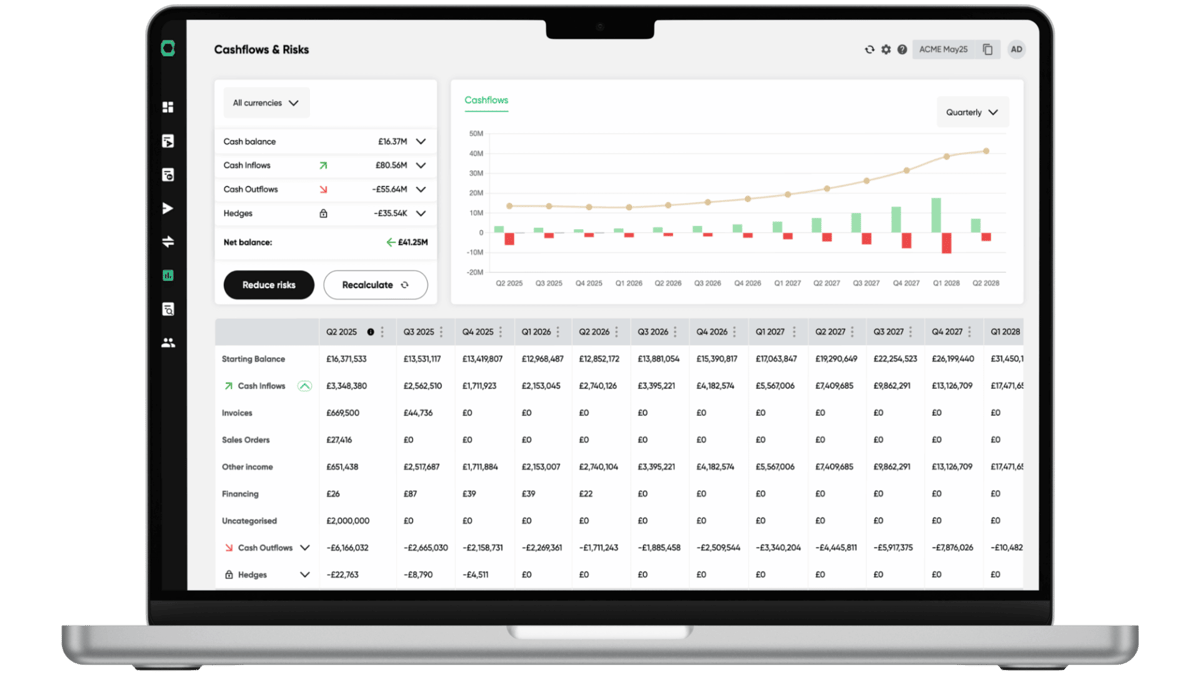

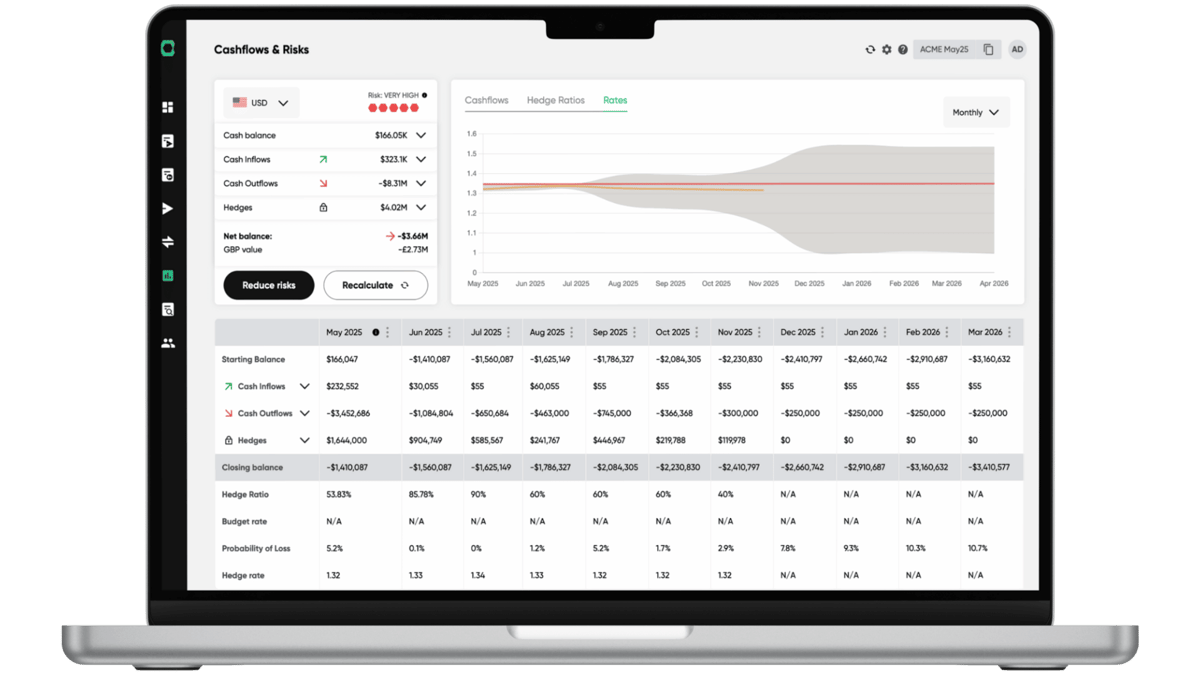

Our TMS handles the execution — hedge accounting, custom ERP integrations, working capital management, and comprehensive reporting across your entire organisation.

Treasury Advisory

Policies, banking, and working capital — designed for your business

Our advisory team brings 20+ years of institutional experience from Standard Chartered and Bank of America Merrill Lynch. We work alongside your finance team to design treasury policies, restructure banking relationships, and find working capital solutions that actually fit your business — not off-the-shelf templates.

- FX risk policy and hedging framework design

- Banking relationship review and renegotiation

- Working capital and trade finance solutions

- Cash management policy across entities and currencies

- Board-ready treasury reporting and governance

Treasury Management System

Then execute with a full TMS and custom integrations

Once your policies and strategy are in place, our platform operationalises them. Full hedge accounting, multi-entity consolidation, and deep integrations with your ERP, CRM, and BI tools — so your treasury function runs consistently and at scale.

- Hedge accounting compliant with IFRS 9 / FRS 102

- Custom ERP integrations — NetSuite, Business Central, and more

- Salesforce, HubSpot, and Power BI connectors

- Working capital management and optimisation

- Public API for bespoke automations

Trusted by mid-market businesses

"Having previously worked at a major bank, I can say HedgeFlows provides the same institutional-grade tools we used there — but designed for businesses like ours."

Jason

CFO, Niarra Travel

"The visibility HedgeFlows gives us across our entities and currencies has completely changed how we manage our finances. We finally feel in control."

Chris

Managing Director, FirstPoint Logistics